Halal Investment: All You Need to Know

Halal investment refers to the investment of money that is according to Islamic finance principles.

According to a study in 2020, Islam has 1.9 billion adherents, making up about 24.7% of the world population.

source: Wikipedia

All Muslims worldwide are keen on making sure that their source of income is halal and compliant with Sharia law, which is clearly stated in the Quran.

Hence, the question concerning how to make halal investment while abiding by Sharia law, in terms of investing, trading, and increasing wealth in a halal way, is prevalent and asked a lot in the Muslim community.

Over the course of history, the terms of halal or haram mainly focused on discussing the concept of sharing food, but they also extended to other matters such as lifestyle and business.

Table of Contents

Benefits of Halal investments

Investments are all about increasing wealth by investing in assets for the purpose of generating returns in the form of income payments or capital gains.

Profits are made when the assets invested increase in value and are then sold consequently at a higher price.

However, all investments include some risks ,and they are not always easy to plan; additionally, the Sharia rules define Sharia-compliant investments, which are not always easy to comply with.

These rules are focused on ethical investment and saving. Furthermore, Sharia laws also take into consideration social justice, non-exploitation, and the benefits related to everyone in the community.

Halal Investment And Building Communities

Islamic finance principles take into consideration the principle of building communities where justice exists, ethics are applied, and finances aim towards benefiting the community.

Overall, the focus is not all about making money but also about balancing religion, family, life, intellect, and property.

Consequently, halal investing makes it possible to increase wealth while recognizing ethical standards and mutual benefits, while Sharia investments reduce the risk in general when applied.

Islamic Financial Principles

The financial principles defined by Sharia law should be compliant with the following Islamic finance principles:

The prohibition of paying and charging interest in Islam.

This is because it is considered an exploitative practice. However, uncertainty is only accepted to a certain extent, and investments should not involve gambling or selling alcohol or be based on speculations in general.

The Positive And The Negative In Halal Investment

The benefits of halal investments include increased social responsibility that could extend to human rights protection, while enabling the growth of wealth in a Sharia-compliant way that minimizes the risks taken.

Conversely, halal investments limit the number of opportunities available for investors and they require dedicating more time to be spent on choosing suitable investments, based on precise information when compared to traditional investments.

Types Of Halal Investments

While halal stocks are considered halal investments, investing in bonds is forbidden because it involves paying interest rates.

Gold investments are considered Sharia-compliant, and they usually increase wealth because they often tend to increase in value.

An alternative for traditional bonds is Sukuks, which are also called Islamic bonds. Sukuks are asset-based and typically provide a “fixed income.”

Moreover, property investments are also considered Sharia-compliant in general.

Sharia-Compliant Industries

Finally, some industries that contradict the central tenets of Islam are not considered Sharia-compliant, such as those focused on alcohol, cigarettes, drugs, gambling, the banking sector that includes interest, and industries related to selling pork products.

Muslims, in general, are supposed to check the financial statements of a company before investing in it to know from where its profits are generated.

If more than 5% of the revenues of a business are generated from an unethical source, then investing in that business would not be a halal investment.

Sharia-compliant companies operate in a halal way and follow a transparent and halal audit process that enforces the application of the Sharia finance rules.

On the other hand, other companies mix halal activities with haram activities, and those companies should be avoided according to the Sharia investment laws.

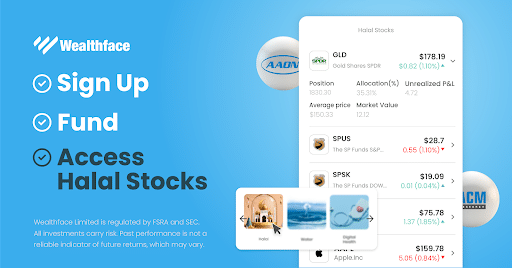

Wealthface is an online investment and trading platform offering the option to make halal investments using their online platform or mobile app. With Wealthface you can start your investment journey without compromising your values.